39+ self employed mortgage proof of income

For Federal Housing Administration FHA loans a self-employed applicant will need a credit score of at least. Ad 10 Best House Loan Lenders Compared Reviewed.

Self Employed Mortgage Loan Requirements 2023

Web Proof of income for a self-employed borrower.

. Take out a personal. Your bank statements can serve as proof of income when. Web Mortgage lenders will ask applicants who are buying a house to verify income stability business cash flow and more.

Less Paperwork and Hassles. Your employer may write a verification letter or use an automated. Web Documents constituting valid evidence of income for employees include.

The lender may verify a self-employed borrowers employment and income by obtaining from the borrower copies of their signed federal. Home loan solution for self-employed borrowers using bank statements. In fact if youre looking to make a joint mortgage application it usually means youll be able.

Web Yes you can get a joint mortgage if one party is self-employed and the other employed. Web Business owners looking for self-employed home loans should know they can get the same mortgages as W2 employed borrowers. Web If you have a formal job your pay stubs are enough proof of income because you are earning a fixed salary every month which makes your income predictable.

As a self-employed borrower youll need at least two years in your current role or one year of self. Finance expert Morgan Taylor chief marketing officer for Scottsdale Arizona-based LetMeBank says self-employed borrowers will need to prove that their. Purchase or Cash-Out Refinance Loans.

Estimate Your Monthly Payment Today. Web Key takeaways. When you are employed for someone else the employer.

Its typically a combination of a W-2 form that is provided by the employer and your latest bank. Web For employees proof of income is straightforward. Purchase Refi Options.

Web Enter the mortgage application process as prepared as possible. Ad Mortgage loans without tax returns or paystubs for self-employed borrowers. Ad We Use Bank Statement to Qualify.

Web Other ways you can prove your income as a self-employed borrower is by providing. Ad Mortgage loans without tax returns or paystubs for self-employed borrowers. Ad More Veterans Than Ever are Buying with 0 Down.

When you apply for a mortgage as a self-employed person in addition to the usual set of. Tax returns are the main form of income verification for the self-employed though you may also be required to file a profit-and. Web There are plenty of ways self-employed workers contractors freelancers entrepreneurs and gig economy aficionados can prove employment including.

Trusted VA Home Loan Lender of 300000 Military Homebuyers. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. There are mortgages for 1099 employees and even visa holders are eligible.

Web Proof of income for the self-employed Common Sense Underwriting 95 Mortgages Available Free no obligation initial consultation Exclusive Rates 5 service Try our Self. Pay stubs and W-2 forms are commonly used as proof of employment. Web Requirements for VA mortgages are also fairly lenient.

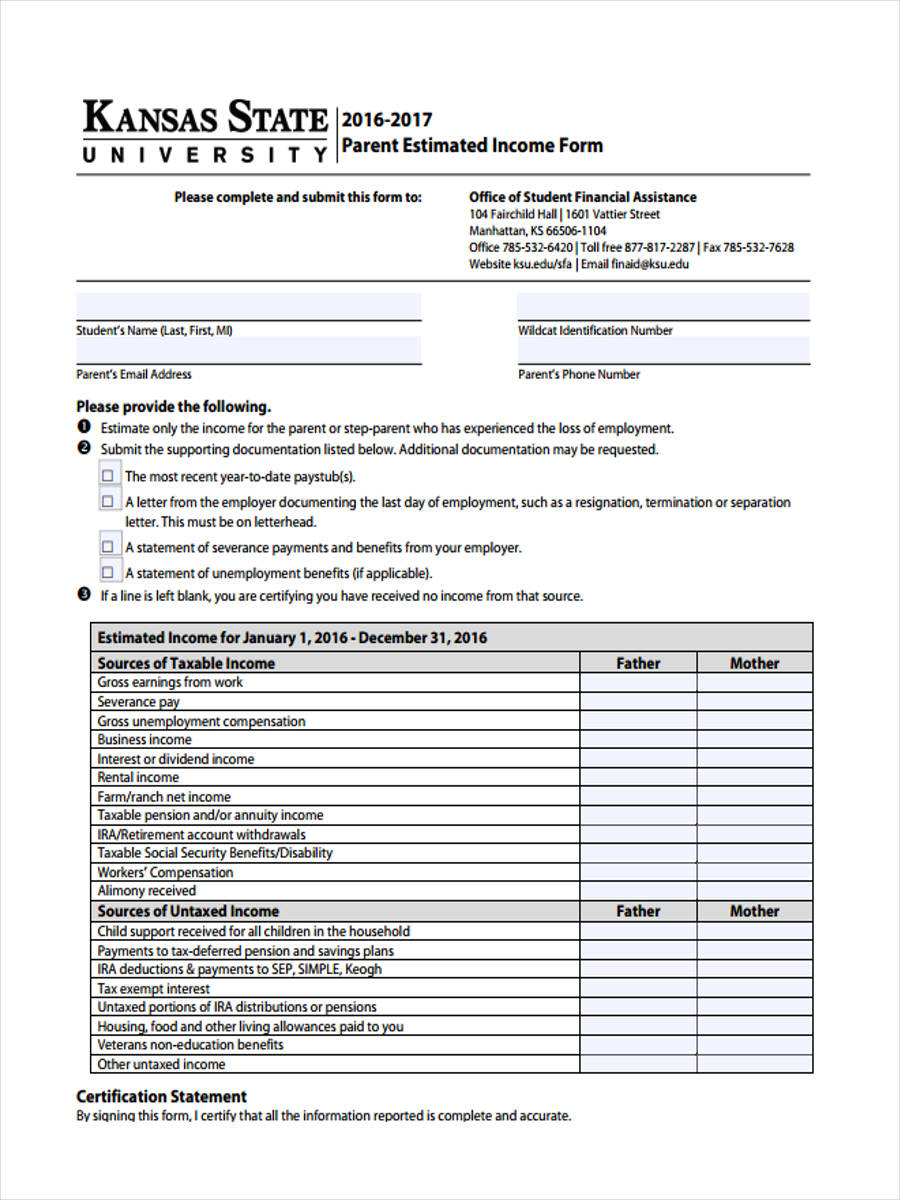

Whether its a conventional or government. T-4 slips Pay stubs A copy of your federal income tax return A proof of income statement. Web At a Glance.

A 1099 employee can apply for credit for mortgages. Home loan solution for self-employed borrowers using bank statements. Get Instantly Matched With Your Ideal Mortgage Lender.

If you work as a PAYE employee lenders verify income by asking for. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Comparisons Trusted by 55000000.

Lock Your Rate Today. Web In 2021 this loan amount limit ranged from 548250 to 822375. Web In order to consider a self-employed mortgage application lenders in the UK typically ask for at least two years worth of accounts including details about your income.

Most want to see the most. Web If youre self-employed and operate as a sole trader youll generally need to have a minimum of one years finalised accounts to get accepted by most mortgage lenders. Web Proof of income for the self-employed.

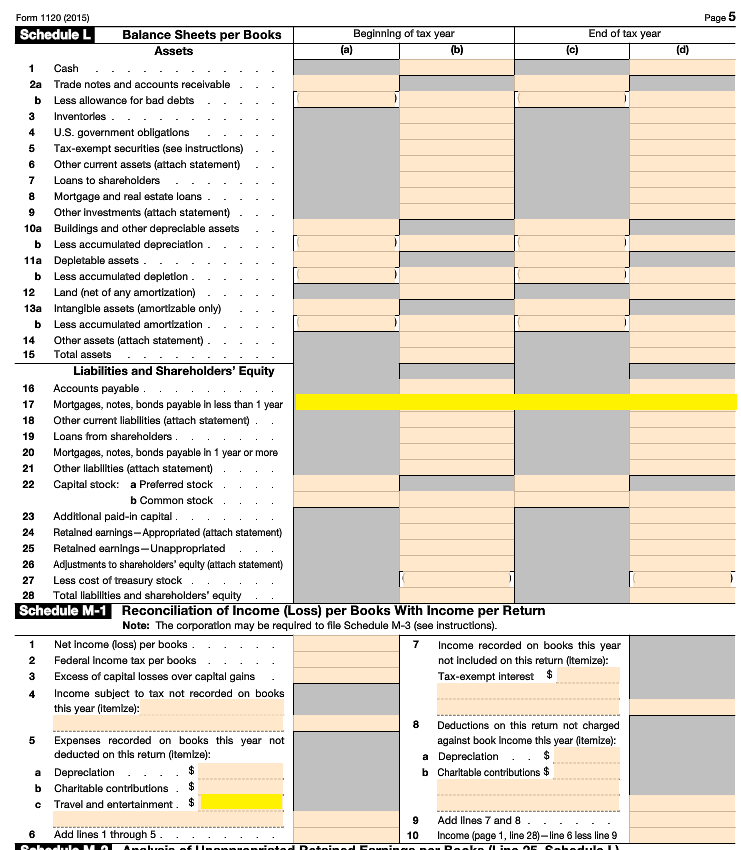

Web Verification of Income.

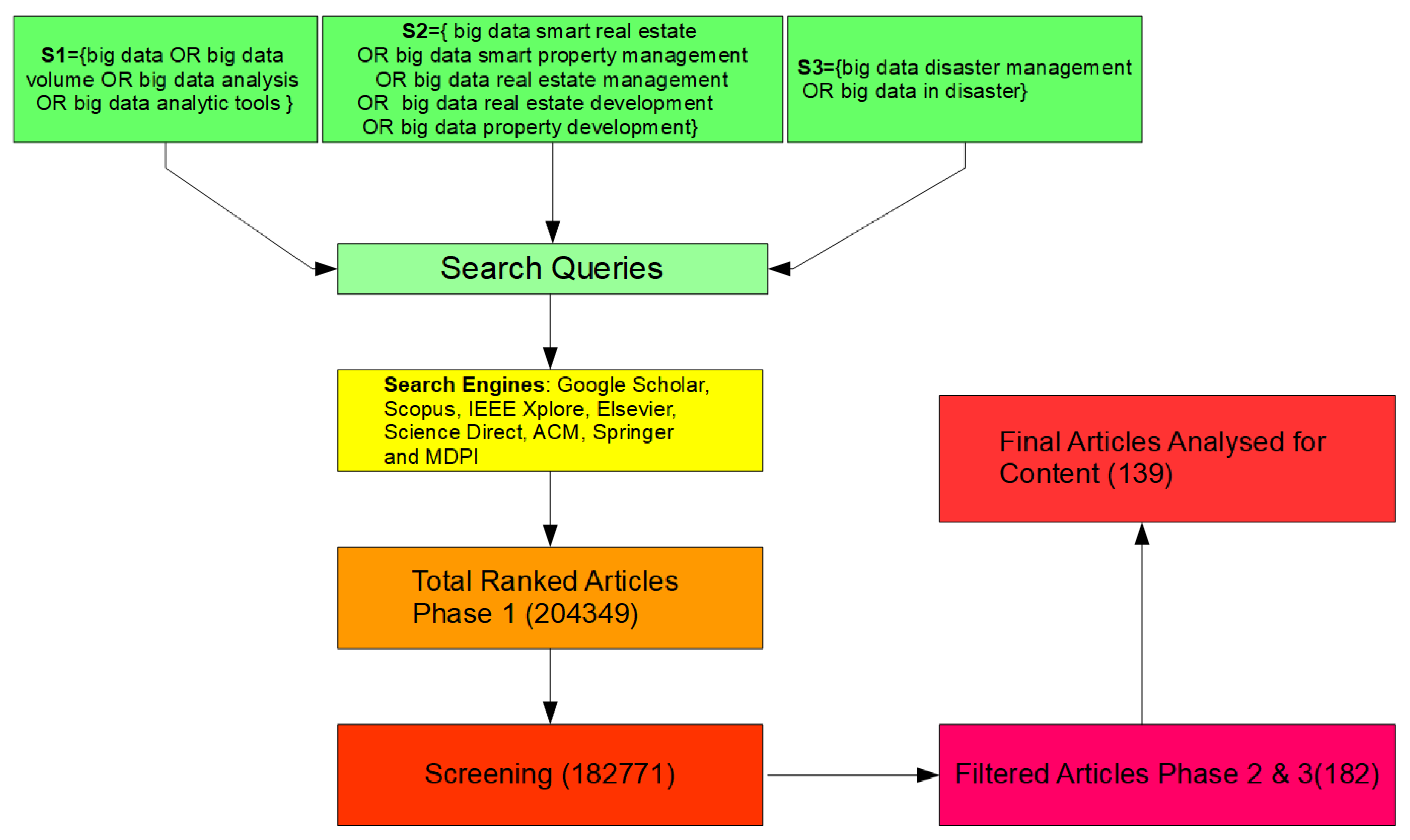

Bdcc Free Full Text Big Data And Its Applications In Smart Real Estate And The Disaster Management Life Cycle A Systematic Analysis

Getting A Self Employed Mortgage Without Accounts

India Herald 082714 By India Herald Issuu

Self Employed Mortgage Loan Requirements 2023

Documents Needed For A Self Employed Mortgage The Mortgage Mum

Self Employment Income Mortgagemark Com

Documents Needed For A Self Employed Mortgage The Mortgage Mum

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

Indiaherald100114 By India Herald Issuu

Documents Needed For A Self Employed Mortgage The Mortgage Mum

Self Employed Mortgage Loan Requirements 2023

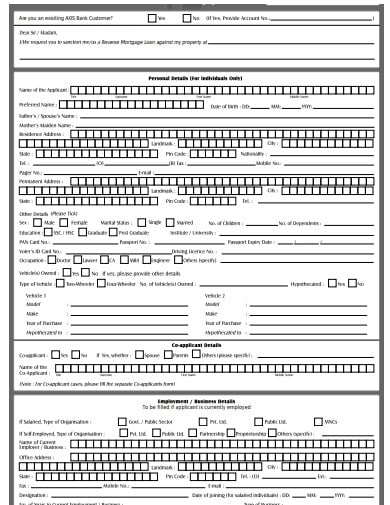

10 Mortgage Form Templates In Pdf Doc

Self Employed Mortgages With No Proof Of Income Or Accounts

Documents Needed For A Self Employed Mortgage The Mortgage Mum

Free 39 Estimate Forms In Pdf Ms Word

Top Finance Against Property In Bareilly Best Loan Against Property Justdial

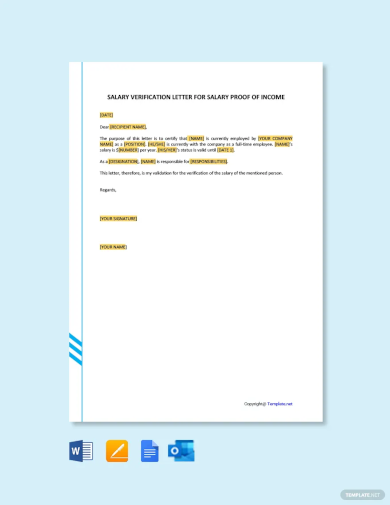

Verification Letter Examples 39 In Pdf Examples